Let your spending be as private as you want it to be!

Wait, what??

Your debit/credit card transactions are not as private as you think. Since they are paying on your behalf, your issuing bank knows all about your morning lattes, Amazon shopping sprees, and last-minute beach getaways. They know how much you spend, where you spend it, where you were when you spent it, and when.

Companies and market researchers mine transaction data to better target advertising, position products, and understand consumer behavior. Visa and Mastercard are in an incredible position at the top of the food chain to provide this data and get paid handsomely for it.

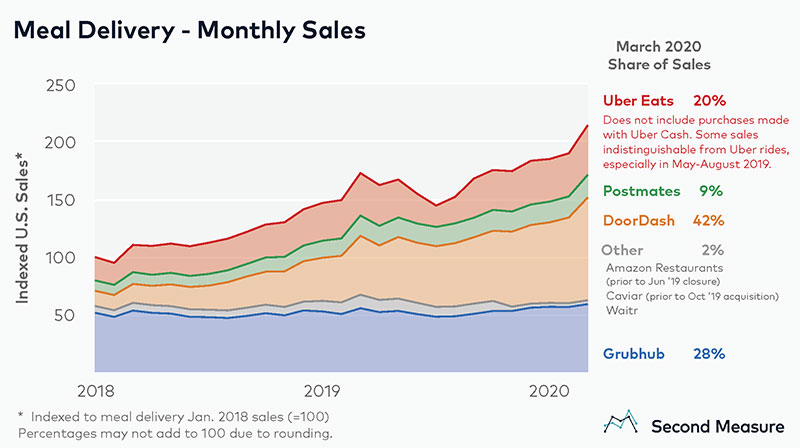

One such company that resells this data is Second Measure. They can make pretty graphs answering just about any question, such as “Which restaurant delivery service is winning?”

Second Measure can also do fancy stuff like cross-correlating transactions:

I do not blame credit card companies for taking advantage of this gold mine of economic data. In fact, I think it’d be leaving a LOT on the table if they didn’t. And if it’s anonymous (and that’s a big IF, via aggregation or differential privacy) then it may actually contribute positively to society by providing companies better insights for decision making. Overall, conspiracy theories aside, market data like this seems like a net positive.

You sign up for this in your credit card agreements (so you did opt-in) and in exchange they provide you credit and rewards (a beneficial trade for many). I’m neither upset nor surprised, I’d just rather not have my data in it if I have the choice—especially if I don’t know all the ways they use my data.

And now you have that choice too 👍